Early Childhood Educator Opportunities!

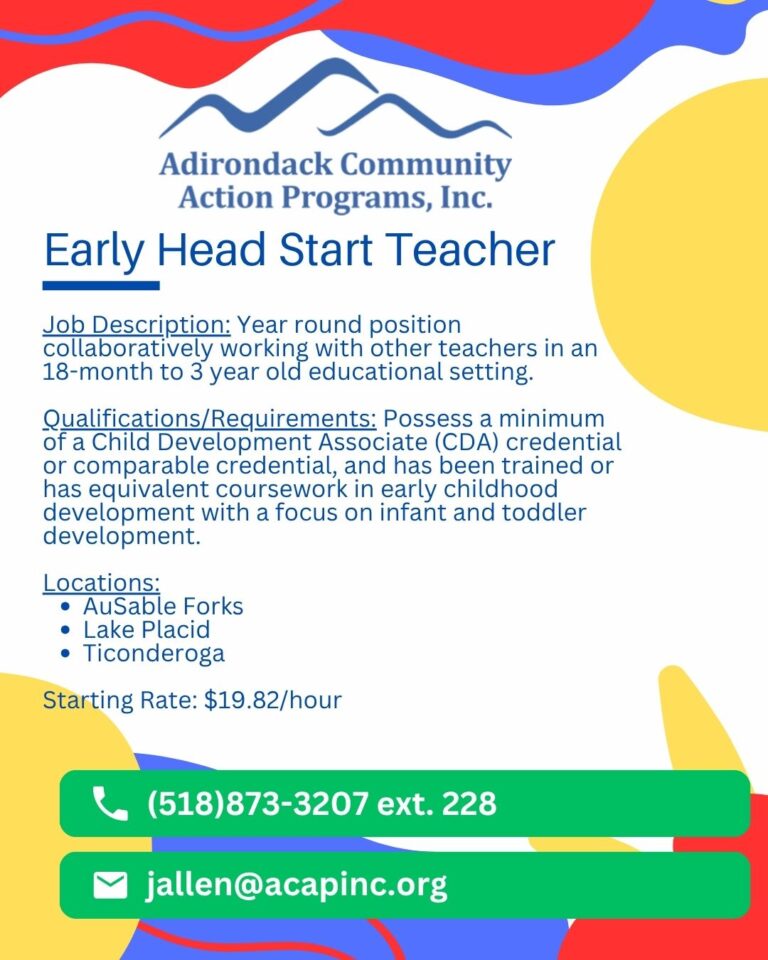

ACAP is hiring two positions for Head Start and Early Head Start in Essex County. Early Head Start Teacher in Ausable Forks, Lake Placid, and…

ACAP is hiring two positions for Head Start and Early Head Start in Essex County. Early Head Start Teacher in Ausable Forks, Lake Placid, and…

Click here to view or download here.

Read BT3’s 2025 New York State Joint Legislative Budget Hearing – Human Services here. Read BT3’s 2025 New York State Joint Legislative Budget Hearing –…

On February 12, 2025, The Adirondack Birth to Three Alliance’s Director, Kate Ryan, delivered oral testimony at the New York State Joint Budget Hearing for…

The BT3 coalition was actively engaged during this year’s legislative session ensuring that our rural families’ needs and wants were considered through months of dedicated…

Juliette Lynch, Family Resource Center and Permanency Resource Center Project Director and Parenting Educator from the Child Care Coordinating Council; Healthy Steps specialist Christy Bezrutczyk;…

The NYS Office of Mental Health (OMH) announces the availability of funds to support the implementation of HealthySteps. Their goal is to promote an intentional…

On February 10, 2025, BT3 and Adirondack Foundation hosted our very first Adirondack Early Childhood Advocacy Day. The day was attended by 15 people (and…

BT3 collaborated with RaisingNY and other partners from across New York State to pinpoint the most common barriers keeping families from accessing high quality child…